A shareholder’s notice of recommendation must set forth: | (a) | as to each person whom the shareholder proposes be considered for nomination for election as a Director | |

| (i) | the name, age, business address and residence address, | |

| (ii) | his or her principal occupation or employment during the past five years, | |

| (iii) | the number of shares of Company common stock he or she beneficially owns, | |

| (iv) | any other information relating to the person that is required to be disclosed in solicitations for proxies for election of Directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, and | |

| (v) | the consent of the person to serve as a Director, if so elected; and | |

| (b) | as to the shareholder giving the notice | |

| (i) | the name and record address of shareholder, | |

| (ii) | the number of shares of Company common stock beneficially owned by the shareholder, | |

| (iii) | a description of all arrangements or understandings between the shareholder and each proposed nominee and any other person pursuant to which the nominations are to be made, and | |

| (iv) | a representation that the shareholder intends to appear in person or by proxy at the meeting to nominate the person(s) named. | |

Board and Committee Oversight Responsibilities The Board has adopted a Statement of Policy Regarding Director Nominations, setting forth qualifications of Directors, procedures for identification and evaluation of candidates for nomination, and procedures for recommendation of candidates by shareholders. | | | 14 |2021 ProxyAs set forth in the Statement of Policy, a candidate for Director should meet the following criteria:

| |  |

| Governance• must, above all, be of proven integrity with a record of substantial achievement.

• must have demonstrated ability and sound judgment that usually will be based on broad experience. • must be able and willing to devote the required amount of time to the Company’s affairs, including attendance at Board and Committee meetings and the annual shareholders’ meeting. • must possess a judicious and somewhat critical temperament that will enable objective appraisal of management’s plans and programs; and • must be committed to building sound, long-term Company growth. |

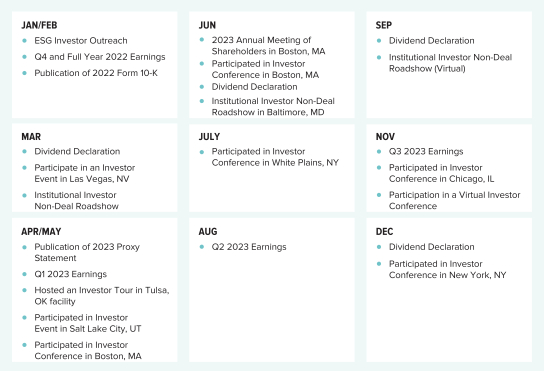

Director Participation and Relationships 2020 presented unprecedented challenges for the Company, necessitating an increased number of Board meetings. Consequently, theThe Board held fifteenfour meetings during 2020 (the majority were telephonic),2023, and all of the Directors who served in 20202023 were present at each meeting. Each Director also attended all of the meetings of each committeeCommittee of which he or she was a member in 2020.2023.

| | |  | | 2024 Proxy Statement| 11 |

| Governance of the Company |

The Board has adopted a policy stating that it is in the best interests of the Company that all Directors and nominees for Director attend each annual meeting of the shareholders of the Company. The policy provides that the Board, in selecting a date for the annual shareholders meeting, will use its best efforts to schedule the meeting at a time and place that will allow all Directors and nominees for election as Directors at such meeting to attend the meeting.attend. The policy further provides that an unexcused absence under the policy should be considered by the Governance and Nominating Committee in determining whether to nominate a Director for re-election at the end of his or her term of office. All of the Directors attended last year’s annual meeting of shareholders. No family relationships exist between any of the Company’s Directors and executive officers.Executive Officers. There are no arrangements or understandings between Directors and any other person concerning service as a Director. CompensationBoard Diversity and Tenure

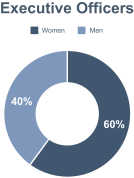

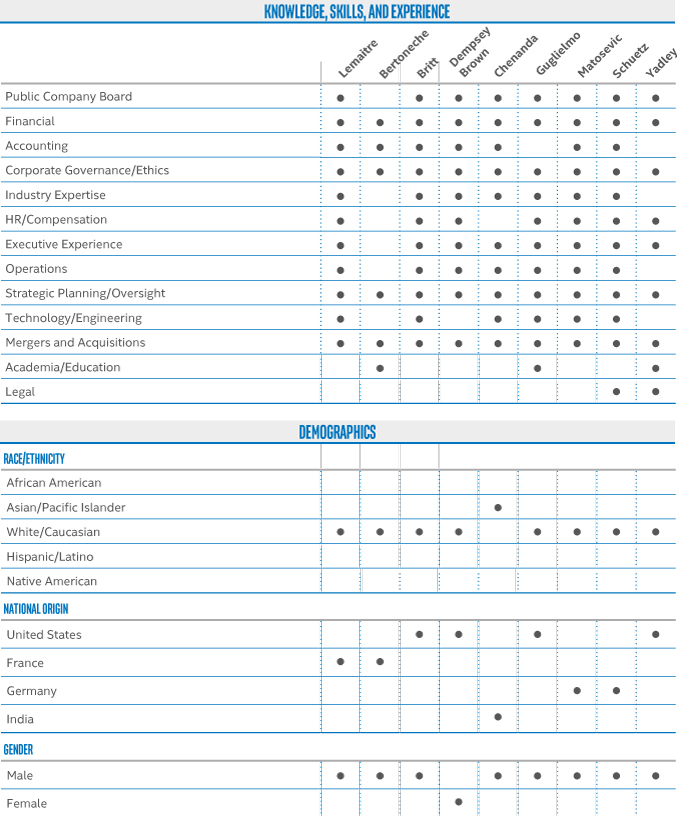

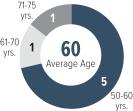

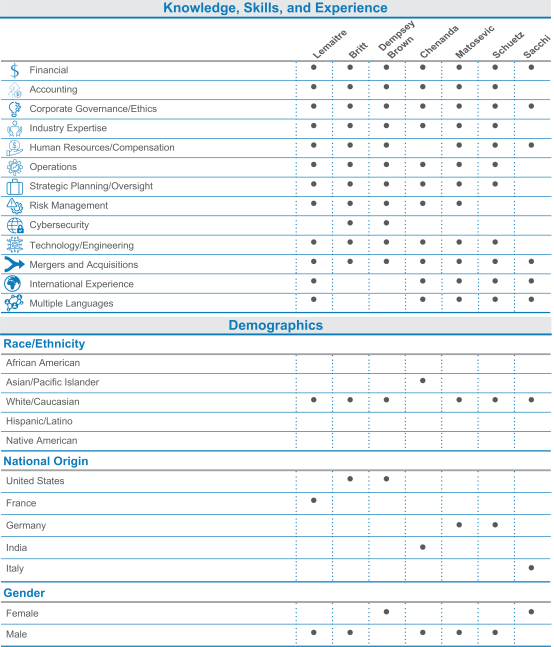

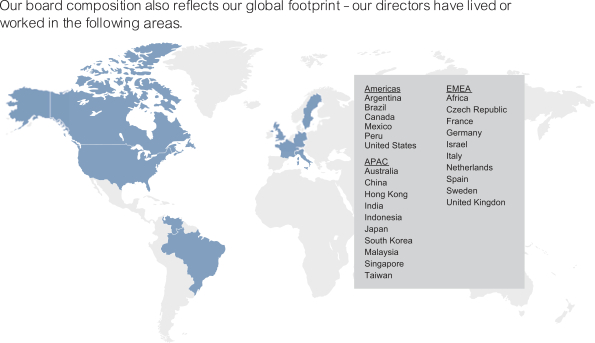

Consistent with the Company’s Corporate Governance Guidelines, the Nominating Committee Interlocks and Insider Participation During fiscal 2020, Marc Bertoneche, Douglas M. Britt, Laura Dempsey Brown, Cary Chenanda, Kennon Guglielmo, Christine L. Koski, Alexander Schuetz and Gregory Yadley served on the Compensation Committee. None ofBoard seek diversity among the current members of the CompensationBoard. The Nominating Committee has been an officer or employeeand the Board believe that considering diversity in terms of our Company. Additionally, none of our executive officersgender, race, national origin, as well as geographic, cultural and subject matter experience, creates a Board that can best serve as a memberthe needs of the Company and its shareholders, and are important factors that are considered when identifying individuals for Board membership. In addition, diversity with respect to tenure is important to provide for both fresh perspectives and deep experience and knowledge of the Company. Therefore, we aim to maintain an appropriate balance of tenure across our Directors.

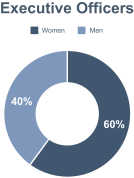

In furtherance of the Board’s active role in succession planning, the Board has appointed or nominated 4 new Directors since 2020. Our Directors reflect those efforts and the importance of diversity to the Board. The Board of Directors adheres to the “Rooney Rule” with respect to its consideration of board candidates, which requires the Board to consider female and minority candidates in connection with vacancies. The Board is committed to considering multiple diverse candidates in evaluating any vacancy on the Board to underscore Helios’s commitment to diversity. In 2022, following the retirement of former Director Marc Bertoneche, the Board was able to further enhance its gender diversity with the nomination and subsequent election of Diana Sacchi to the Board. Of the last three independent Board Members that have been appointed or nominated since 2020, the Company is proud to report that two-thirds or sixty-six percent (66%) have been female. The six independent directors or compensation committee of any other entity that has one or more executive officers serving as a member ofon our Board or Compensation Committee.are now composed of 33% female Directors (excluding our President & CEO Josef Matosevic). In furtherance of the Board’s active role in diversity, 50% of the Committee Chairs are women. Section 16(a) Beneficial Ownership Reporting Compliance Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s Directors, officersOfficers and holders of more than 10% of the Company’s Common Stock to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and any other equity securities of the Company. ToExcept as disclosed below, to the Company’s knowledge, based solely upon a review of the forms, reports and certificates filed with the Company by such persons, all of the Company’s Directors, officers,Officers, and holders of more than 10% of the Company’s Common Stock complied with the Section 16(a) filing requirements in 2020, except for2023. In 2023, (i) each of Philippe Lemaitre, Doug Britt, Laura Dempsey Brown, Cary Chenanda, Diana Sacchi and Dr. Alexander Schuetz who filed onea late Form 4 late.that reported one late transaction. Communications with the Board of Directors Shareholders and other parties interested in communicating with our Board may do so by writing to the Board, Helios Technologies, Inc., 1500 West University Parkway,Attn: General Counsel & Secretary, 7456 16th Street East, Sarasota, Florida 34243. Under the process for such communications established by the Board, the Chairman of the Board reviews all such correspondence and regularly forwards it, or a summary of the correspondence, to all of the other members of the Board. Directors may at any time review a log of all correspondence received by the Company that is addressed to the Board or any member of the Board and request copies of any such correspondence. Additionally, correspondence that, in the opinion of the Chairman, relates to concerns or complaints regarding accounting, internal accounting controls and auditing matters is forwarded to the Chair of the Audit Committee.

| | | 12 |2024 Proxy Statement | |  |

| Governance of the Company |

Independence and Committees of the Board of Directors | | | Current Members: Doug Britt (Chair) Laura Dempsey Brown Philippe Lemaitre The Audit Committee held 8 meetings in 2023. Each of the current members of the Audit Committee is financially literate and satisfies the heightened independence standards of Rule 10A-3 under the Exchange Act. | | The Board determined, under applicable SEC and NYSE rules, that all of the members of the Audit Committee are independent, and that Mr. Doug Britt meets the qualifications as an Audit Committee Financial Expert, and he has been so designated. The Audit Committee is responsible for, among other things: - Reviewing and approving the selection of the Company’s independent public accountants who will prepare and issue an audit report on the annual financial statements of the Company and a report on the Company’s internal controls over financial reporting; - Establishing the scope and fees for the prospective annual audit with the independent public accountants; - Reviewing the results thereof with the independent public accountants; - Reviewing and approving non-audit services of the independent public accountants; - Reviewing compliance with existing major accounting and financial policies of the Company; - Reviewing the adequacy of the financial organization of the Company; - Reviewing management’s procedures and policies relative to the adequacy of the Company’s internal accounting controls; - Reviewing areas of financial risk and providing fraud oversight; and - Reviewing compliance with federal and state laws relating to accounting practices and to review and approving any transactions with affiliated parties. The Audit Committee also invites and investigates reports regarding accounting, internal accounting controls or auditing irregularities or other matters as well as provides oversight for the Company’s compliance with its Code of Conduct, including its confidential ethics reporting hotline. The Code of Conduct is available on the Company’s website at: https://ir.heliostechnologies.com/governance-docs. No waivers of the Company’s Code of Conduct were requested or granted during the year ended December 30, 2023. The Code of Conduct is available on the Investors page of our website and from the Company upon written request sent to the Corporate Secretary, 7456 16th Street East, Sarasota, Florida 34243. |

| | | Current Members: Diana Sacchi (Chair) Cariappa Chenanda Alexander Schuetz (During 2023, Doug Britt served on the Compensation Committee) The Compensation Committee held 4 meetings in 2023. Each of the current members of the Compensation Committee satisfies the heightened independence standards of Rule 10C-1 under the Exchange Act. | | The Compensation Committee is responsible for, among other things: - Overseeing the Company’s compensation program, including executive officer and key management compensation; - Administering the Company’s equity incentive and non-employee Director fees plans; and - Carrying out the responsibilities required by the rules of the SEC and NYSE. The Compensation Committee may delegate any of its responsibilities to one or more subcommittees, each to be comprised of at least two of the Compensation Committee’s members. For information regarding the role of our executive officers and the Compensation Committee’s independent compensation consultant in determining or recommending the amount or form of executive compensation, see “Executive Compensation — Compensation Discussion and Analysis” below. None of the current members of the Compensation Committee have been an Officer or employee of the Company. Additionally, none of our executive officers serve as a member of the Board of Directors or Compensation Committee of any other entity that has one or more executive officers serving as a member of the Board or Compensation Committee. |

| | |  | | 2024 Proxy Statement| 13 |

| Governance of the Company |

| | | Current Members: Laura Dempsey Brown (Chair) Cary Chenanda Philippe Lemaitre (During 2023, Alexander Schuetz served on the ESG Committee) The ESG Committee held 4 meetings in 2023. | | The ESG Committee is responsible for, among other things: - Developing and recommending to the Board corporate governance guidelines and policies for the Company; - Overseeing the annual individual performance evaluation on all Board members; - Overseeing the enterprise-wide risk management policies of the Company; - Monitoring the Company’s compliance with good corporate governance standards; and - Overseeing the Company’s significant ESG and sustainability activities and practices. The ESG Committee is committed to ensuring the governance of the Company is in full compliance with the law, reflects generally accepted principles of corporate governance, encourages flexible and dynamic management and effectively manages the risks of the business and operations of the Company. |

| | | Current Members: Alexander Schuetz (Chair) Doug Britt Diana Sacchi (During 2023, Laura Dempsey Brown served on the Nominating Committee) The Nominating Committee held 4 meetings in 2023. | | The Nominating Committee is responsible for, among other things: - Developing and recommending to the Board for adoption, qualifications for members of the Board and its Committees and criteria for their selection; - Reviewing and recommending changes which the Committee determines advisable; - Identifying and reviewing the qualifications of potential candidates to fill Board positions; - Reviewing the suitability for continued service of each Board member prior to term expiration; and - Recommending to the Board the nominees to stand for election at each annual meeting of shareholders. The Nominating Committee will take whatever actions it deems necessary under the circumstances to identify qualified candidates for nomination for election as a member of the Board, including the use of professional search firms, recommendations from Directors, members of senior management and shareholders. All such candidates for any particular seat on the Board are evaluated based upon the same criteria, including those set forth above and such other criteria as the Committee deems suitable under the circumstances existing at the time of the election. |

| | | 14 |2024 Proxy Statement | |  |

| Governance of the Company |

Our Purpose, Mission and Shared Values Shape our Culture

The Helios Business System was developed through a transparent stakeholder process that included our employees, customers, and investors. Internally, we worked across the organization to look at our future—how we are going to win, and how we are going to design and build a business system to create a strong differentiation and separate ourselves from the competition. This continues to be the heart of what we do. Our purpose is to provide trusted global brands that deliver technology solutions that ensure safety, reliability, connectivity and control. Our Shared Values include accountability, integrity, inclusion, innovation, and leadership. We believe we embody our purpose and values in all that we do as an organization. This is the foundation for the Helios Business System. We learned that to be our best, we must achieve our mission which includes: | • | | Protecting the business by driving cash flow, developing innovative new products, and creating strong, customer-centric relationships |

| • | | Thinking and acting globally by leveraging global resources and assets, supporting diverse end markets, accelerating innovation, being “in the region for the region” |

| • | | Diversifying markets and revenue, by leading with new technology, and recognizing new opportunities |

| • | | Developing talent by embracing diversity, promoting our Shared Values, promoting a learning organization, instilling a customer- centric culture, and engaging global talent |

Our mission is inclusive of not only our strong emphasis on being financially responsible, but also recognizing the non-financial aspects of our business and strategy: the environmental, social and governance topics we must consider if we are to continue to grow and deliver on our purpose. | | |  | | 2024 Proxy Statement| 15 |

| Governance of the Company |

As an organization, we use our Shared Values as a guide to ensure we act in everyone’s best interest to achieve our mission. We seek to implement our Shared Values throughout our approach, including the ability to recognize and manage Environmental, Social and Governance (ESG) Matters In 2020, Helios(“ESG”) risks and its Board affirmed its commitment to ESG matters as an integral part of the Company’s business strategy. To underscore its commitment, the Board recently created a new Committee entitled “Environmental, Social and Governance,” whose charter will be to assist the Company in its oversight of corporate social responsibilities, significant public policy issues, health and safety, and climate-change related trends and other global ESG matters in addition to overseeing all corporate governance matters pertaining to the Company.opportunities at Helios. These Shared Values are:

| | |   | | 2021We work to keep our promises We communicate openly and transparently to build trust and create strong relationships through clear expectations and collective goals. We seek to do the right thing We are honest, fair, transparent, and always act with the highest standards of ethics to create the trusting relationships that are the lifeblood of our business. We treat others with dignity and respect We believe we should treat others as we want to be treated by creating an inclusive, welcoming environment for our colleagues and their ideas. We cultivate intellectual curiosity to inspire creativity We create innovative solutions to solve real problems that delight our customers and set us apart from our competition. We passionately deliver excellence We are driven to exceed expectations and to motivate excellence in our organization. |

These Shared Values are for the entire organization and every employee, no matter their role or function. They are the foundation from which we work and drive our organization forward each day. | | | 16 |2024 Proxy Statement| 15 | |  |

| Governance of the Company |

Aligning our Company’s Goals with our Culture Meeting our goal of becoming the leading provider of premier products and solutions in specialty niche markets through innovative product development and acquisition requires an overarching approach that addresses the core values of our entire business. Every component of our Purpose, the structures we are creating to reach our goal, and our clear step-by-step tactics reflect this goal. Our Shared Values and Mission seek to implement our goal, allowing and embedding that focus across our organization. Our end market performance illustrates the value of deploying these key ESG enablers throughout the Company as well. | | |

| |  Building in the Region, for the Region Building in the Region, for the Region

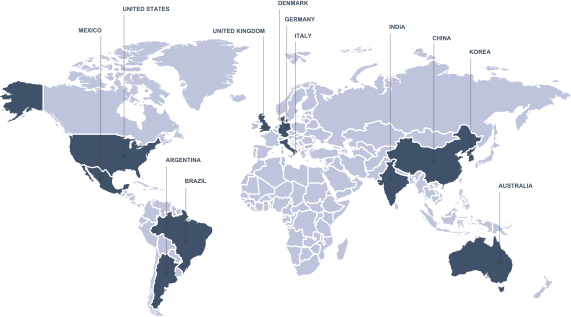

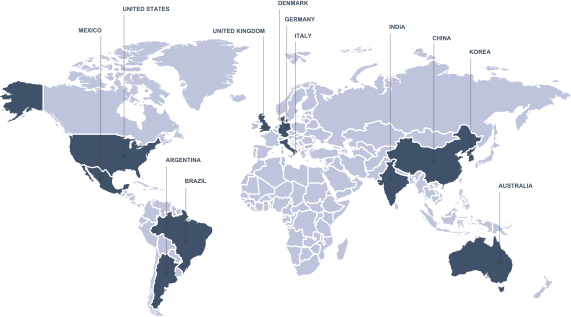

Being “in the region, for the region” is a direct reflection of the strength of the Helios Business System and our ability to use our Shared Values as a guide to create new and innovative approaches to our business. As part of our transformation to an integrated operating company, we have developed a unified operations strategy across the companies in our Electronics and Hydraulics segments. This strategy leverages the breadth of our global footprint and depth of our manufacturing capabilities. In support of our mission to “Think and Act Globally”, we are driving “in the region, for the region” manufacturing to better align supply chain and manufacturing value streams with customers geographically to shorten lead times, reduce inventory, optimize costs, and mitigate global supply risks. Established manufacturing centers provide scale in North America, and we continue to expand centers in both Asia and Europe to meet growing global demand. Manufacturing locations in the U.S., Canada, Mexico, Italy, Germany, South Korea, China and India provide a range of manufacturing options. We source and supply what we can from a regional perspective while staying true to our focus on delivering high-quality innovative products to our customers. This approach has helped us expand our engineering capacity, scale resources, and develop additional internal capabilities and allow us to produce and sell our solutions locally. This creates value for our customers and shareholders by significantly reducing sourcing and supply risks, avoiding freight costs, and reducing quality issues. The supply chain for electronics and hydraulic components is complex with many risks, but when viewed through an ESG lens, the opportunities are clear. Our approach to building “in the region, for the region”, as part of our manufacturing strategy, helps us not only address risks like material shortages, environmental footprint and adding diverse talent to our team, but enables us to positively impact the economies and communities in which we operate, all while protecting our margins. Environmentally, this approach has a significant impact on shipping-related emissions and mitigating weather-related risks and delays. From a social and economic perspective, we are positively impacting local economies. We can attract and retain local talent with diverse perspectives: those who help us create innovative new solutions as well as those in operational functions such as Finance and Human Resources.  Proven Merger and Acquisition Framework Proven Merger and Acquisition Framework

We have a proven Merger and Acquisition framework around both flywheel and transformational acquisitions which adds value for our customers, partners and shareholders, as well as provides development opportunities for our employees. We seek companies with innovative cultures who will add capacity and capabilities, fit within our strategic imperatives, and actively prioritize environmental and social responsibility. Our recent acquisitions are examples of strong companies with strong cultures firmly aligned with our commitment to corporate responsibility. The clear priorities we have for companies we acquire are realized because our proven integration model focuses on the retention of employees, strong customer relationships, brand integrity, leveraging engineering expertise, and management culture. | | |

| | |  | | 2024 Proxy Statement| 17 |

| Governance of the Company |

| Manufacturing and Operational Centers of Excellence (“CoE”) |

Our world-class manufacturing is a competitive tool and a key component of our long-term strategy. As part of our transformation to an integrated operating company, we have developed a unified operations strategy across the companies in our Electronics and Hydraulics segments. This strategy leverages the breadth of our global footprint and depth of our manufacturing capabilities. We completed key Capital Expenditure Projects including the creation of two Regional Operational Centers of Excellence for our Hydraulics segment in North America, the construction of a second facility in Tijuana, Mexico to meet demand and growth for our Electronics segment, as well as the construction of an automated warehouse at our Faster, Italy location. | 1. | The facility expansion in Mishawaka, Indiana from our acquisition of Daman Products Company (“Daman”) has become the Hydraulic Manifold Solutions CoE. Helios added 50,000 square feet to the existing 72,000 square foot facility and will combine the manifold machining and integrated package assembly operations from Sun Hydraulics in Sarasota, Florida, the integrated package business from Faster Inc. in Maumee, Ohio and expands Daman’s capacity for core organic growth. |

| 2. | Additionally, Faster’s North American quick release coupling manufacturing has been relocated from Maumee, Ohio to one of the Sun Hydraulics facilities in Sarasota, Florida as part of the ‘Hydraulic Valve and Coupling Solutions CoE’. We have transformed approximately 27,000 square feet of existing space to streamline operations, provide space for future coupling manufacturing, and facilitate technological advancements through our Robert E. Koski Center of Engineering Innovation, enabling the creation of cutting-edge hydraulic solutions for our valued customers. |

| 3. | In response to the growth opportunities for products from its Electronics segment, Helios has expanded into a newly constructed building in Tijuana, Mexico, adding 68,000 square feet of capacity to its existing 198,000 square foot facility. While water-based technology and software solutions remain at the core of Balboa’s expertise, the new facility supports the future growth of the Balboa business along with Helios’ overall Electronics segment, which also includes Enovation Controls and our recent acquisition, i3 Product Development (“i3”). As a part of Helios’ ‘in the region for the region’ manufacturing and operating strategy, several Enovation Controls products are already being manufactured at Balboa and this capacity expansion will enable further room for growth as Helios continues to become a global integrated operating company. The expanded space will also be leveraged for growth in intra- and inter-segment system sales, wire harnessing, and innovative product development. It showcases the Company’s dedication to strengthening its leadership positions in its respective end markets while leveraging those strengths to collectively advance its technological capabilities. This will enable Helios to offer even more innovative solutions to diversified end markets. |

| 4. | Our Faster location has been expanded with two additions. First, Faster has added an additional 3,200 square meters (34,400 square feet) of production shopfloor to increase its turning capacity on behalf of SUN and NEM with the aim of becoming a central production hub for the entire EMEA region. A new department of milling machines and cast-iron manifolds has been added for products intended for Faster’s Original Equipment Manufacturers (“OEM”). A prototype department has been created exclusively for R&D testing and sampling for customers as well. Second, our Faster location has been expanded with a newly constructed automated warehouse. The new innovative, flexible, and efficiently built automated warehouse expands our Regional Hydraulics capabilities in Europe and enables us to better service our customers while leveraging a best-in-class manufacturing and operating approach. Built over a nine-month period, the Faster Automated Warehouse is an advanced facility that measures 2,100 square meters (22,600 square feet) has capacity for 6,900 pallets and can service up to 190 pallets/hour. Its central location will allow service to customers globally and advances the Company strategy to support increased: |

| • | | Efficiency: The Faster Automated Warehouse means increased efficiencies — and opens 2,100 square meters (or 22,600 square feet) of floor space in the existing building that can be leveraged for manufacturing. |

| • | | Sustainability: The automated warehouse enables space optimization in the plant to be dedicated to new assembly and turning lines. Additionally, it minimizes the consumption of land by allowing for verticalization. |

| • | | Innovation: The automated processes provide for more accurate and timely service for customers. |

| • | | Flexibility: The layout of the automated warehouse is expandable and enables handling of multiple pallet sizes depending upon the requirements of customers globally. |

| • | | Growth: Together with space saving and flexibility comes the ability to grow production as well as space to allow employees to be trained on and develop new skills tied to new processes and technologies. |

| | | 18 |2024 Proxy Statement | |  |

| Governance of the Company |

| 5. | Our Faster, India location has been doubled with the addition of 22,000 square feet. This expansion was carried out for the production of turned components for quick couplings, starting assemblies, and direct sales for the Indian local market. Additionally, the expansion of the production capacity for the milling of cast iron manifolds is underway which includes Faster, Sun Hydraulics and NEM, and will serve as a key production hub in India serving the Motion Control Technologies and Fluid Conveyance Technologies (“MCT-FCT”) Helios Hydraulics segment. |

| | |  | | AcceleratingInnovation |

Engaging diverse teams to create products, many of which keep end users and our environment safer, starts with a customer-centric culture of innovation, a system solution for our customers, and continues through our responsible approach to manufacturing. We believe the acquisition of i3 (as described below), will expedite the Company’s efforts to be the most innovative company in the Hydraulics and Electronics market with profitable engineering, consulting and product development services for customer specific solutions. In most cases, when we design products, especially electronics, we do so in co-development and co-design with the OEM. This allows us to understand and assess any environmental or social risks associated with the solution. Innovation also extends to the investments we make which results in more energy and materials efficient design and modification. Creating Components that use Less Energy Through testing and advanced simulation, we intend to improve the energy efficiency of the products we create, including reducing energy use and heat waste. Our brands have adopted this practice as an ongoing initiative for all product designs. As an example, Faster, in their development of a new quick release coupler, will design all components involved with oil flow to be hydrodynamic to improve total coupler flow rate capacity resulting in lower energy consumption. At Sun Hydraulics, testing is performed to determine leakage between the ports of the valve that could result in the valve failing due to pressure drop within the circuit. This approach is not only a critical safety step, but from an environmental standpoint there is also improved energy efficiency of a hydraulics system (less electric or mechanical power to power the system). The eSenseTM solution boasts 100% of the performance at 30% of the power consumption while the LoadMatchTM valve offers 30% or more energy savings from automatic control settings at reduced loads.  | Diversifying Markets and Products |

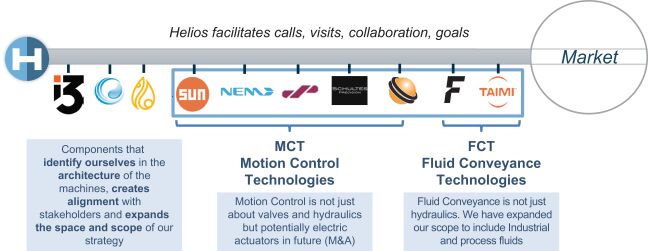

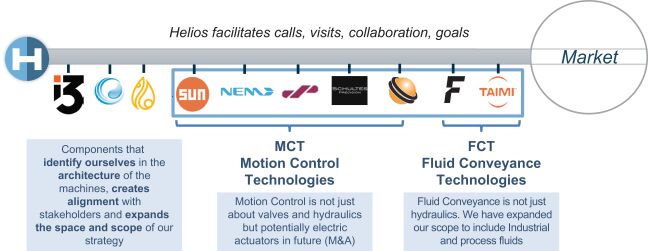

Helios continues to focus on providing systems and solutions that solve our customers most pressing requirements. With a differentiated product portfolio and through continuous innovations, we believe our team is in prime position to create aggressive go-to market approaches focused on system sales. Helios also has a responsibility to create products that are long-lasting, keep end-customers safe, and leave as little negative impact on the environment as possible. We regularly review our processes to determine where and how they can be improved to reduce our energy consumption and that of our customers. We also recognize this focus leads us to new markets and solutions that align with our own focus on social and environmental responsibility, for example, in 2023 our commercial strategy was enhanced by enabling our customers’ success with integrated electro-hydraulic and engineered solutions from across the “busbar” of technologies in our portfolio. One of the key drivers of future growth for both the Electronics and Hydraulics segments is our system sale approach that leverages electronic and hydraulic solutions from our trusted brands. While protecting our existing business, we will provide strategic OEM partners with “system solutions” that ensure the safety, reliability, connectivity and control of their applications. Our two segments are comprised of approximately 125 direct sales and application specialists serving our customers’ needs. We will continue to use this long successful approach while augmenting our strategy by pursuing system sales at key global OEM’s to drive growth. Our Hydraulics segment have critical components that identify ourselves in the architecture of the machines as well as creates alignment with stakeholders and expands the space and scope of our strategy. With a combination of Motion Control Technologies (“MCT”) which include the Sun Hydraulics, NEM, Daman, Schultes and CFP brand, with Fluid Conveyance Technologies (“FCT”), which include our Faster and Taimi brands, we are creating critical sealed parts for our customers who demand top performance. The conversations with our customers have now switched from providing great performing parts from our individual brands, to a value proposition which provides: Parts in body solutions which optimize space, flow & performance; Machine casting bodies which reduce weight and cost; | | |  | | 2024 Proxy Statement| 19 |

| Governance of the Company |

Global supply capability – scalable based on manufacturing in region; and, Quick attach couplers which improve uptime and attachment accuracy. We will accelerate promotion of the Helios brand through system sales while remaining focused on our well-established operating brands.

Our Electronics segment consists of leading international brands in custom-tailored solutions for many industrial and commercial applications, including engines, engine-driven equipment and specialty vehicles with a broad range of rugged and reliable instruments such as displays, controls and instrumentation products through our Enovation Controls, Zero Off, Murphy and HCT brands. With the Balboa and Joyonway brands, we are also an industry leader in the health and wellness market providing globally comprehensive electronic control systems with proprietary and patented technology for therapy bath and traditional and swim spas from a single source. Our focus is on creating customized systems that solve complex problems for our customers. This allows us to target customers or industries that see value in this level of integration, and as a result, our product list contains a wide variety of OEM applications. Product categories include traditional mechanical and electronic gauge instrumentation, plug and play CAN-based instruments, robust environmentally sealed controllers, hydraulic controllers, pumps and water flow systems, engineered panels, process monitoring instrumentation, printed circuit board assembly and wiring harness design. Our systems can be used in both mobile (DC power applications), as well as fixed (AC power applications). | | | 20 |2024 Proxy Statement | |  |

| Governance of the Company |

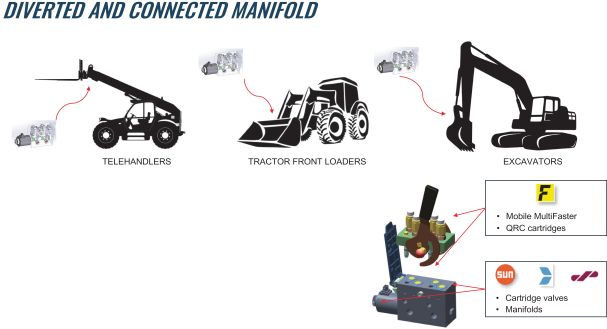

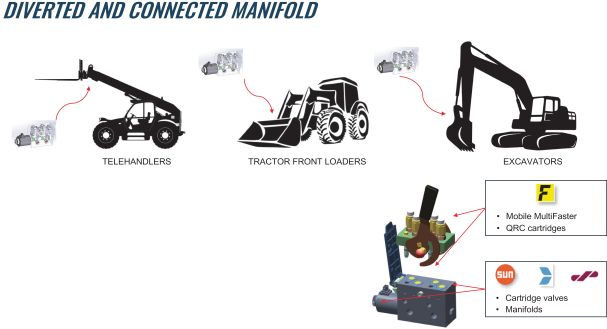

2023 Product Highlights Diverted & Connected Solutions Diverter valves are very popular to make machines versatile and easily install hydraulic tools that require additional lines not originally available. The tilt cylinder flow is the function typically diverted to control for example grapple buckets for telehandlers, excavators or tractor front loader. Thanks to the ‘Diverted & Connected’ Faster solution, all the necessary elements to equip the machine are in a single and smart product, making the installation easier and increasing the reliability of the system. Installation will be fast and easy with an increased reliability of the hydraulics system with potential leak points being reduced due to the additional hoses and fittings. This solution also includes valves and manifolds from Sun Hydraulics, NEM and Daman.

OpenPV | | | | OpenPVTM is a sophisticated set of tools that empowers software developers to create complex applications for rugged OpenPVTM | | displays offered by Enovation Controls. Offered as a free download and designed from the ground up to be a modular system, OpenPVTM enables developers to create the UI/UX on Company Linux-based OpenViewTM displays with tools such as Qt and Crank Storyboard software development tools. This platform offers experienced developers the freedom to design and implement their tailored applications using their preferred tools and contemporary programming languages. | |

|

Cygnus Remote Support Platform | | | | Cygnus Remote Support Platform allows manufacturers and distributors the ability to provide their technicians the tools to be anywhere |

| | with a customer using video streaming and screen sharing features, as well as access equipment software to be able to remotely service the product real time in the field. Developed as a software as a service (SaaS) platform to address customers’ challenge of providing service and support to their end customers in a timely, cost-effective manner, service and support technicians can remotely access equipment, see everything a user sees, and identify a solution in record time. |

| | |  | | 2024 Proxy Statement| 21 |

| Governance of the Company |

Additionally, the Board adopted several new policies and procedures that underscore its commitment to ESG matters. Highlights include:Taimi Swivel Cartridge

| | | | The integration of the Taimi Swivel Cartridges through the distribution channel of its operating company, Sun Hydraulics provides the | ESG Policy & Procedure Highlights

| • Corporate Responsibility Policy (including Human Rights Policy)expansion of product offerings for Sun Hydraulics longstanding sales distribution channels around the globe.

• Code of Conduct for SuppliersThis complementary technology allows Taimi’s uniquely designed components to synergize with Sun’s conventional high quality hydraulic solutions to enter new end markets. These include forestry, marine, offshore, robotics, cranes, underground and Third-Party Vendors (including Policy Against Human Trafficking & Slaveryopen pit mining, construction and demolition, agriculture, railway construction and maintenance, solar power, drilling and material handling.

| | • Conflict Mineral Policy

|

PowerViewTM P70 | | | | With its combination of advanced features, premium display quality, and rugged durability, the PowerViewTM P70 is the perfect solution |

| | for both powersports and industrial customers who demand the best and another example of leveraging a new platform across more than one end market to achieve a multiplier effect. With a 7-inchedge-to-edge, all glass, full-color touchscreen format, the all-new P70 sets the industry standard for sunlight-readability from its optically bonded 1000 Nit glove-friendly display. It also boasts the full I/O (input/output) complement of the PV485, making it a powerful and versatile device. It is packed with features such as Bluetooth, CAN and an internal GPS receiver and 2.5 zone audio out, making it the best choice for powersports OEMs who demand top performance and functionality. 2.4GHz Wi-Fi will also be available in a future software release. For the industrial | | market, it offers the same core technology, rugged reliability and high-performance as the PV700 in a higher value format. Designed with all-weather durability, it features a rugged, IP67-rated housing that protects against water, dust, and shock, making it suitable for use in the harshest environments. |

How we Approach Environmental, Social and Governance (ESG): A key to our continued growth and innovation abilities is having a deep awareness and understanding of not only our own environmental and social impacts, but those that impact our entire value chain. This perspective is notably reflected in the integrated approach we use to design and manufacture the components we create: from solutions that reduce our customers’ impact on the environment all the way through to how we source materials and use efficient and safe manufacturing practices. This drives us to design and manufacture highly engineered motion control and electronic control technologies: to make the world better, safer, and even more fun. | 1. | Internally, our shared values of accountability, Integrity, Inclusion, Innovation and Leadership, are essential to our Helios Business System and guide us to ensure our ESG responsibilities are not managed in silos but connected holistically across every function of our organization. |

| 2. | Externally, investor and customer-centric engagement, as well as frameworks such as the United Nations Sustainable Development Goals (UN SDGs) and the Sustainability Accounting Standards Board (SASB), assist us in identifying ESG impacts that could potentially affect our business and provide insight to the environmental and social topics influencing the industries we serve. |

| 3. | The key characteristics of our augmented strategy – a scalable, relevant plan that guides us to make progress in a meaningful and achievable manner – is also reflective of how we embed ESG across our operations, including: |

Employing the Helios Business System to hold ourselves accountable; Establishing Board-level ESG oversight and ethical policies; | •Anti-Hedging Policy (Update) | | Managing non-financial and ESG topics to support our long-term business strategy; |

Recognizing and acting upon our own environmental impacts and how a changing climate could impact our business, the markets we serve and the products we design; | | | 22 |2024 Proxy Statement | |  |

| Governance of the Company |

Attracting and developing a global, diverse team of innovators and providing safe, efficient manufacturing facilities; and Supporting our employees and the communities in which we operate. And just like the components we create that help make the world better, our comprehensive approach to ESG makes us better. We invite you to read about our progress in this proxy and follow our journey at: https://heliostechnologies.com/esg. Holding Ourselves Accountable through Strong ESG Governance | | |  | | Board Level ESG Governance |

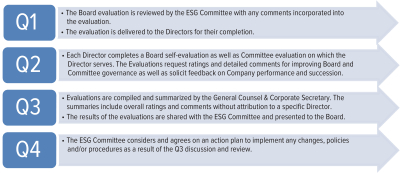

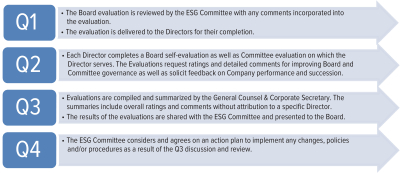

ESG Committee Accountability starts with board-level oversight of ESG to address non-financial topics of interest to our investors, shareholders, and other stakeholders. In March 2021, the Board created the ESG Committee to oversee risks related to the Company’s environmental, social, corporate governance practices, as well as enterprise risk and other matters. In 2022, we added the Chairman of our Board to the ESG Committee. The purpose of the ESG Committee is to (a) develop and recommend to the Board corporate governance guidelines and policies for the Company, (b) monitor the Company’s compliance with good corporate governance standards and oversee the evaluation of the Board and management against these standards, and (c) oversee the Company’s significant ESG and sustainability activities and practices, which include, among other things, reviewing our ESG and sustainability strategy, initiatives and policies and updates from the Company’s management committee responsible for significant ESG and sustainability activities; charitable contributions by the Company; and community reinvestment activities and performance thereof. 2023 Board Evaluation Program | | | | SELF-EVALUATION | | The Board understands that honest and practical evaluations are crucial for good governance and Board effectiveness. Annual evaluations focus on two primary functions of a Board: oversight and decision-making, with an emphasis on Board process, and Board composition. The ESG Committee oversees the annual evaluations with the assistance from the General Counsel & Secretary, and conducts a multi-step process to disseminate, collect and review the results. The ESG Committee then discusses the results of the evaluations and other feedback in a closed session with the Board. | BOARD AND COMMITTEE EVALUATION PROCESS • Code of Business Conduct and Ethics (“Code”) (Update)

| | IMPLEMENTATION & RESULTS | | Confidential evaluations and subsequent discussions from the evaluations were instrumental in making enhancements to meeting materials, committee compositions, the Board evaluation process, and interactions with our business leaders, providing Directors with further opportunities for continuing education. |

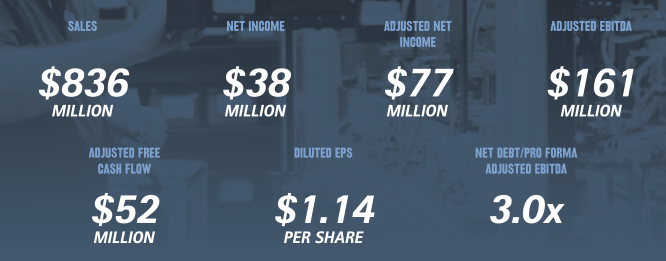

As summarized below, 2020 was

| | |  | | 2024 Proxy Statement| 23 |

| Governance of the Company |

| | |  | | ESG Responsibility throughout the Organization |

2023 Risk Management Program A successful Risk Management program is critical for the Company to both understand the risks it faces as well as understand the significance of those risks. Effective risk management means attempting to control, as much as possible, future outcomes by acting proactively rather than reactively. An effective risk management program offers the potential to reduce both the possibility of a yearrisk occurring and its potential impact. In 2022, the Board charged the ESG Committee with oversight and responsibility of significant progress towardsthe Company’s Risk Management Program, and to work closely with management to ensure key controls and processes are in place. In response to this new oversight, the Company worked with the ESG goals for Helios acrossCommittee to create a strong internal process to effectively identify, analyze, and manage risks facing the globe.Company. Rather than an annual risk assessment at an enterprise level, the Company created an internal risk management structure administered by subsidiary sub-committees formed at Sun Hydraulics, Faster, Enovation Controls and Balboa, whereby representatives within each business unit, including Finance, Human Resources, Sales, Operations, Safety and Information Technology, meet on a quarterly basis to:

GOVERNANCE/BUSINESS CONDUCTIn turn, these risks were reported up the General Counsel & Secretary and Chief Executive Officer, who then reported on a quarterly basis to the ESG Committee regarding risks facing the Company, mitigation factors that management has employed to address those risks, and other information relating to how risk analysis is incorporated into the Company’s corporate strategy and day-to-day business operations. The ESG Committee, in turn, reported out these risks to the full Board on a quarterly basis. In 2023, the Company organized presentations around top trends to consider and presented a Safety as well as Cybersecurity presentation for the Committee and Board. Additionally, the Sun Hydraulics sub-committee was expanded to include facilities in Mishawaka and Buffalo Grove and renamed ‘Helios Hydraulics Americas.’

Our Operations function continues to have the main oversight responsibility to ensure Helios provides enhanced disclosure on environmental issues and continues a targeted approach to address risks and material concerns in the way we design, manufacture, and deliver our products. This approach will help eliminate risks to shareholders and their financial interests while promoting leadership accountability. | | |  | | Ethics and Compliance |

The Helios Legal function oversees the Ethics Hotline and Global Ethics Code, including ethics and discrimination training of all employees, and works with the Human Resources department to launch company-wide initiatives like our charitable giving platform through America’s Charities and the Helios Employee Assistance Fund. Our high ethical standards are the DNA that drive us as we protect the business, think and act globally, and diversify end markets. Our commitment to fundamental ethical principles, including diversity and respect for the dignity of every individual, is reflected in our ethical policies and compliance measures. Now more than ever, in such a rapidly changing world, we leverage and lean on our collective guiding principles and codes to provide clear guidelines towards ethical practices and decisions. Code of Ethics Helios is committed to conducting ourconducts business with the highest degree of ethics, integrity, and integrity.compliance with laws worldwide and our Code of Ethics and Business Conduct Code reflects this commitment. Our Codes include policies to protect our company’s reputation, one of our most valuable assets. Maintaining our reputation is critical to retaining our talented employees, loyal channel partners and supportive shareholders. This expectation is memorializedCode also exists in conjunction with both the policiesCorporate Responsibility Policy and procedures applicable to our employees, vendors, and partners across the globe. All our operating companies maintain their own individual ethics and code of conduct policies, the collective policies of which are also incorporated into our corporate policy, the Code. In 2020, every Helios employee across the globe was required to complete an ethics training course and to acknowledge the Code. In addition, Helios companies maintain ethical and conduct standards for their suppliers across the globe and require all suppliers to execute a Code of Conduct for Suppliers and Third-Party Vendors. In 2020, we Annually, our colleagues acknowledge receipt and understanding of this Code, and attend required ethics training courses in connection with the Code. Helios tracks compliance through a third-party organization who provides training on these topics as well as learning and development. Courses include such topics as: Workplace Harassment; Diversity and Inclusion; Non-Retaliation for Reporting; Information | | | 24 |2024 Proxy Statement | |  |

| Governance of the Company |

Security; Conflicts of Interest; Fair Dealing; Confidential Information & Intellectual Property; Data Privacy; Creating a Respectful Workplace; Corporate Assets; Environmental; Health & Safety; Fair Employment Practices; Maintaining Books & Records; Anti-Bribery & Anti-Corruption; International Trade Controls; Antiboycott Laws; Antitrust & Fair Competition Laws; Compliance with Laws; Rules & Regulations; Communications & Public Affairs; and Contracts Compliance Policy. Anonymous Inquiries and Reporting: We provide an anonymous third-party incident management program, Navex, for all employees to report concerns and suspected violations of the Code. Navex is available to all employees via the internet or through a telephone hotline. The third-party employees who interact with third party suppliersanswer the Reporting Hotline are trained to attendlisten carefully, ask questions and document the situation accurately and anonymously. There is never any retaliation for making a training session on the prevention of human trafficking and slaveryreport in our supply chain. Helios maintains a confidential ethics and reporting hotline thatgood faith. Navex can be accessed by employees all over24 hours a day, seven days a week via the globe (heliostechnologies.ethicspoint.com). Both the Audit and ESG Committees of the Board oversee the ethics and compliance programs of the Company. Our Chief Legal and Compliance Officer oversees our ethics and compliance programs and provides advice and counsel on a regular basis to Helios and its employees on these topics.following web address: www.heliostechnologies.ethicspoint.com.

Information Security Disclosure

Our Board remains active in reviewing our information security exposure and risks. In 2020, our Governance and Nominating Committee, composed of all independent Directors, was responsible for reviewing our information security risks quarterly. Some of our Directors have information security experience and have the knowledge and skills to provide valuable guidance. Beginning in 2021, the same responsibility will move to the newly formed ESG committee. Our Board also receives a comprehensive review of information security measures annually.

In 2020, Helios bolstered its Cyber Security posture by implementing a three-tiered security strategy, focusing on user training, email hygiene, and real-time monitoring. This strategy also assists in identifying and mitigating information security risks. To address user training, Helios implemented a cyber security training platform to raise employee awareness across all its businesses. These trainings are delivered monthly and provide trainings ranging from password best practices to recognizing malicious links. Additionally, Helios has standardized a powerful email filter, protecting users and recipients from dangerous email attachments. Further, Helios implemented a powerful 24/7 security operations center (SOC) to monitor every Helios computer system in real-time and alert the IT team of any potential danger. The SOC also utilizes a preconfigured IT “playbook” to automatically neutralize threats based on predetermined criteria. Together, these tiers of security greatly reduce the Helios attack surface. Helios has not experienced a material information security breach in the last three years.

Responsible Corporate FundingPolitical Contributions

Consistent with the policies set forth in our Code, Helios does not use any corporate funds for the purposes of political advocacy. We recognize that using corporate funds for political advocacy is restricted in many territories. Helios identifies using corporate funds for political advocacy purposesWe define this as making donations or payments for lobbying or campaign contributions, or contributions to tax-exempt groups including trade associations. contributions. In 2020,2023, Helios did not use any corporate funds to engage in political advocacy with any individual, group, trade association, or political entity. Information Security Helios’s three-tiered security strategy, focusing on user training, email hygiene, and real-time monitoring continues to assist us in identifying and mitigating information security risks. We provide monthly cybersecurity training for employees and have also implemented multi-factor authentication (MFA), principles of Zero Trust and password complexity policies for all accounts to help prevent unauthorized access to our systems and data. We also employ a Security Operations Center (SOC) for real time end point protection monitoring. The SOC uses Artificial Intelligence (AI) as well as experienced security professionals to address information security threats. In 2023, the Company participated in penetration testing at the corporate level as well as Sun Hydraulics, Faster, Enovation Controls and Balboa. Penetration tests employ a battery of hacking tools used to map out our forward-facing assets and to find vulnerabilities that could be exploited. The Company’s IT Department uses this penetration testing to evaluate its current posture and to make adjustments as needed. These results are also reviewed with the executive leadership team and the Company’s Board of Directors. Testing continues to be an annual event and will include newly acquired companies as they go through our integration process. The methodology used for Penetration testing is as follows:

| | | | | | | | | 16 |2021 Proxy Statement Pre-

Engagement | |  Intelligence Gathering and Recon |

| Exploitation | | Post Exploitation | | Reporting | Governance of the Company Define goals and objectives

|

Environmental and Social Responsibilities Matters

Since its inception, Helios has developed business policies and practices that support our business model and philosophy of running an ethical organization that embraces its corporate citizenship responsibilities. During 2020, a highly unusual year, our business responded with both a socially responsible and environmental approach.

Our focus:

Giving back to our planet by becoming more energy efficient and environmentally friendly;

Giving back to our communities, supporting their causes during an eventful season of political, social and health unrest;

Giving back to our employees by driving inclusivity, diversity and equity in the workplace; and

Giving back to our shareholders, aligning our governance practices to their interests and vision.

Our commitment to sustainable, ever-evolving efforts in the areas of environmental and social responsibility is clearly outlined by the allocation of resources that we dedicate to ensure we can have a focused approach to planning, execution, continuous improvement, auditing and tracking of our environmental, social and governance (ESG) efforts.

ENVIRONMENTAL RESPONSIBILITY

| | | | | | | | | In 2020, Helios made several strides in its efforts to be responsible stewards of the environment. Our commitment was underscored by the creation of a new role, Senior Vice President of Global Manufacturing Operations. In this role, our senior VP will take a holistic approach to our operations as they relate to cost, quality, | |  Compile relevant information about target including DNS, public IP and employee usernames

| |

Exploit any potential findings | |

Inventory any new information gathered | |

| safetyCompile vulnerabilities, exploit vectors and environmental stewardship. This position will have the main oversight responsibility to ensure Helios provides enhanced disclosure on environmental issues and that it continues its new direction of a targeted approach to address risk and material concerns in the way we design, manufacture and deliver our products while eliminating risks to shareholders and their financial interests and promoting leadership accountability. Further, as detailed below, Helios companies across the globe had tangible results in the elimination of waste, reducing our carbon footprint, and being good stewards to our environment. |

TALENT DEVELOPMENT, DIVERSITY, INCLUSION AND COMPENSATION

| | | | | | | We believe that human resource management’s material impact to our business cannot be overstated. From the increase of employee productivity through engagement and a positive work environment to the bottom line impact the reduction of turnover can have, it is our intention to continue self-assessing and developing our ability to thrive in how we manage this critical aspect of our operation. | |

| |

| |

exploits |

In 2020, Helios continuedThe Company also extended its commitmentscyber-training out to talent development, diversity, inclusion and fair compensation practices. As set forth in the Company’s Code of Conduct & Business Ethics and the Corporate Responsibility Policy, Helios is committedemployees who do not normally have access to workplaces free of discrimination or harassment of any kind and focused on increasing diversity. As highlighted below, the Helios companies demonstrated their commitment to these topicscomputer systems through policies and procedures, training, hiring practices, and corporate events.classroom instructor led trainings.

| | |   | | 20212024 Proxy Statement| 17 25 |

| Governance of the Company |

SOCIAL RESPONSIBILITY AND JUSTICE, CORPORATE CITIZENSHIP & ECONOMIC GROWTH

| | | | | | | | | In 2020, we celebrated fifty years of our pioneer business unit. Fifty years of establishing a strong presence as a corporate citizen. Although our historical commitment to enrich our local communities has never faltered, this past year’s unique social, health and financial developments | |  | |  | |  | |  | tested our resolve to balance being active corporate citizens, delivering products to maintain lifesaving and food production applications and safeguarding our business profitability. Although we have much to celebrate, we believe that all our efforts in social matters deserve a special focus. |

ToA large part of our success is reflective of the positive impact we make on the world around us. Our Corporate Responsibility Policy represents a vision for how we can continue to support Helios inimprove our company, including its special focus on corporate giving, volunteerism, employee relief, and other giving, the Company has partnered with a third-party to continue guiding and expanding our efforts to take action on important social issues that allow us not only to serve our neighbors, but to tell the world where we stand on relevant ethicalfinancial performance, by incorporating environmental sustainability and social issues. This partner, with a long tenure administeringresponsibility both in our daily operations and long-term goals. Key components of the social responsibility efforts of other organizations, will support our efforts to provide relief to our own employees while also identifying service opportunities that allow us to address a variety of social needs within our communities. It will also help us to track our actions and investment to deliver these services, creating public confidence and goodwill and mitigating the risk that negative publicity and potentially costly litigation can have in instances where an organization fails to take action or fulfill their duty on important social issues. Inappropriately managed social risks can also be detrimental to the value of a business and a threat to shareholder value. Our new program will help us with the oversight of these risks, as well as the effective management of our resources and those of our employees who are committed to exercise their civic and social duty in a responsible, compassionate and conscientious manner.policy include:

ENVIRONMENTAL MATTERS – OUR PLANET

| | | We take great pride in protecting the environment, and we want to preserve the beauty of our planet for generations to come.

Our commitment to being good stewards of our environment has continued not only with isolated energy consumptions actions, but with a systematic approach to monitoring our operations from a functionality, energy and quality perspective. Our approach focuses not only on a change in operations, but also on product design, and extending our energy-efficiency efforts to our end users. We also established metrics and associated with industry auditing firms to certify our efforts, resulting in important designations.

| |  |

| | | 18 |2021 Proxy Statement

| |  |

| Governance of

Sustainability and the Company |

Here are some of our most significant accomplishments:

| | | Environmental Stewardship – Energy EfficiencyEnvironment

• Energy efficient product design and modification: These snapshots (pictured right) are from CFD Simulation (Computational Fluid Dynamics). There are two efficiencies gained with simulation. First, we optimize pressure drop in the valve to reduce energy consumption when the valve is in use. Second, simulation allows virtual optimization so there are fewer iterations done with real hardware, thus reducing material usage, processing, etc. This is an excellent illustration of our new way to handle product design and modification to ensure energy efficiency for us and our end users.

| |  |

Electricity improvements: In Italy, we improved energy efficiency by changing LED lights in production areas from 6,000 to 16,800 lumens while maintaining the same consumption in Watts. In Korea, our efforts resulted in an increased electricity efficiency from 87% to 95%.

Facility updates: We improved our cooling efficiency by switching from a straight cool unit to a Variable Air Volume (VAV) system, removed an old fire suppression system and upgraded to an environmentally friendly system, upgraded all new motors to high efficiency (greater than 95%) and created electric vehicle charging stations in 2020 with more to be installed in 2021.

Energy use monitoring:Our process now includes ultrasonic checks for leak determination and replacement of various fittings to reduce compressed air losses.

Product design improvements: We established a new control scheme for test stand control, increasing efficiency, reducing energy and heat waste and resulting in lower energy consumption for our customers.

Environmental Stewardship – Recycling

Reusage: Our business units reused packaging (up to 98% reusage rate), logistics waste and shipping materials intra-company and third party, creating a highly efficient, cost-effective and environmentally friendly packing and shipping recycling program. This effort included the collection of plastic trays that were sent back to suppliers for reuse.

Paper use reduction: By inserting the Quick Response Code (QR) code on packaging, it allowed for elimination of the paper manual. Our new system of reference drawings also eliminates the need of printouts. We eliminated paper catalogs by establishing a web-enabled catalog that allows original equipment manufacturers (“OEM”) and distributors to order and submit modifications online. In addition, we introduced three new environmentally friendly models to our MultiFaster product family, reducing the use of chemical painting resulting in reduction of business cost and paper usage.

Waste reduction: We streamlined processes to drastically reduce solid scraps and oil waste. All in-house generated scraps are now sold to scrap vendors for recycling. We also redoubled recycling and scrap material management in our facilities.

Recyclable packaging: Helios business units changed packaging material for shipment from Sealed urethane foam and film to recyclable materials (paper and air cushion). Further use of urethane foam and film has been permanently discontinued as of 2020.

Facility recycling efforts: At one of our Florida facilities, we recycled 25 tons of steel, 20 tons of aluminum and 27 tons of cardboard in one year. In Italy, our “Green Together” initiative established organic food in vendor-only machines, avoiding the use of plastic, recycling and reusing material and exclusively utilizing a water dispenser to reduce paper consumption. In addition, we have fully transitioned from plastic to cardboard coffee cups in all vending machines.

| | |  | | 2021 Proxy Statement| 19 |

| Governance of the Company

|

Environmental Stewardship – Emission & Waste Reduction

| | | | |  | | • New technology: We received a John Deere Supplier Innovation Award for our industry-leading design that enabled a 75% reduction in leak points and purchased components on a combine harvester (pictured right).

• Process improvements: In Korea, we changed our washing method for integrated packages from a solvent/thinner product to a degreasing process. Compared to 2018, this change reduces the usage of methylene chloride from 3,000 liters to 0 liters annually.

| |  | We have eliminated the use of Freon 113 in manufacturing, we are converting our warehouse forklifts from propane to electric power to reduce C02 emissions and we are converting all hand soldering operations to lead free solder. In 2020, we installed spill protection and plastic reduction in our facilities.

|

One of our Florida facilities successfully diverted 270,000 gallons of wastewater per year from the local sewer system.

Goals have been set for all new and revised product designs to reduce the probability of leaks, reducing environmental contamination. We maintain supplier relations ensuring vendors provide certification on an annual basis on their compliance with REACH (Registration, Evaluation, and Authorization and Restriction of Chemicals), to ensure our third-party associates are truly committed to the protection of human health and the environment from chemicals contained in our manufactured goods and as well as and not operating in conflict mineral regions. We also require our suppliers to ensure they are compliant with RoHS (Restriction of Hazardous Substance) Directive to ensure their products are “lead-free” and do not contain any of the 10 substances restricted by RoHS. This helps to ensure our suppliers are truly committed to the wellbeing of their associates, while protecting the environment from toxic chemicals.

| | | Social Matters

How do we serve others?

As reflected in our Corporate Responsibility Policy Helios is committed to giving back to the communitiescontains six areas in which we serve as well as encouraging positive social action. We strive for alignment with the recognized United Nations Sustainable Development Goals (SDGs). We believe these goals are the roadmap for businesseswe can make significant strides

in enhancing our processes to align their business objectives, strategybecome a more efficient and execution with the world in which they exist.

| |

Conflict Minerals; Carbon and Climate; Product Innovation; Recycling; and Environmental Accountability.

| | + | At Balboa Denmark, many team members make

Social Responsibility We believe that responsible business practices require mutual respect, a strong ethical code, and an investment

into improving the conscious choicelives of those within our community. In addition to rideupholding the values set forth in our

Code of Business Conduct and Ethics, we continue to enhance seven areas in which we strive to promote a

responsible corporate culture: Human Rights; Diversity and Inclusion; Employee Engagement;

Talent Development; Community Investment; Employee Safety, Health and Wellness; Product Safety,

Quality, and Brand. We recognize that the mission to build a better world for people, our planet, and our organization, begins with

each one of us. Therefore, all of our employees, no matter their bikesrole or area of responsibility, are expected to work instead of their cars (pictured right) to create less CO2 emissions

read and protectcomply with the environment.Corporate Responsibility Policy. |

Human Rights Policy Helios strives to operate with the highest ethical standards including upholding human rights. We believe all people should be treated with dignity and respect. We maintain a Human Rights Policy in addition to our Code of Business Conduct and Ethics, as well as our Code of Conduct for Suppliers and Third-Party Vendors. Guided by the United Nations Sustainable Development Goals, the policies cover specific subjects to ensure human rights are protected across our value chain and that we are creating a fair and ethical workplace, including: Fair Treatment; Diversity and Equal Opportunity; Stakeholders and Society; Fair Labor and Compensation Standards; Safe Work Environment; Natural Resources; and Reporting of Violations. Conflict Minerals Policy As a corporation with a global supply chain, we recognize we have a responsibility to improve our own business operations by identifying and mitigating, where practicable, any processes that may harm the planet or the people that live on it. Our Conflict Minerals Policy operates in conjunction with our Code of Conduct and Supplier Code. The policy also aligns with the goals set forth in the Organization for Economic Cooperation and Development Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas. Helios strives to go beyond its obligations under Section 1502 of the Dodd-Frank Act and is working to improve our ability to trace and investigate any potential conflict mineral issues. Our goal is supply chain transparency and the promotion of high ethical standards among our suppliers. To do so, we have established a management system for compliance with conflict minerals regulations and a cross- functional team to implement the conflict minerals compliance strategy, consisting of members from supply chain, finance, legal & compliance, and operations, overseen by the General Counsel & Secretary. | | | 20 26 |20212024 Proxy Statement

| |   |

| Governance of the Company |

DIVERSITY, INCLUSION & EQUITYTo further strengthen our governance, we have partnered with a leading third-party provider of compliance management processes, tools, and expertise to augment our conflict minerals compliance processes and management system. Our reporting process with our provider ensures comprehensive coverage and brings subject matter expertise to complement our internal knowledge and experience.

Code of Conduct for Suppliers and Third-Party Vendors Helios’s culture emphasizes individualHelios’ reputation is based on not just our own conduct, but the conduct of those with whom we do business. This is most evident in the longevity of the relationships we have with many of our suppliers. We value our reputation for conducting business with integrity initiative and responsibility.respect. Our Code of Conduct for Suppliers and Third-Party Vendors (“Supplier Code”) provides a foundation for Helios and its Suppliers to build and maintain a strong business relationship based on trust, respect, integrity, and fairness.

Under the Helios Human Rights Policy, and Helios Policy Against Human Trafficking and Slavery for Suppliers, we require suppliers, business partners, contractors, and other third parties (collectively, “Suppliers”) to share our same commitment to ethical business practices as outlined in the Supplier Code including: Ethical Compliance; Integrity and Transparency; Compliance with the Law including the United Kingdom Modern Slavery Act of 2015, California Transparency in Supply Chains Act of 2010 and operational standards of the International Convention for the Safety of Life at Sea (SOLAS) and Countering America’s Adversaries Through Sanctions Act (CAATSA); Fair Labor Standards and Human Rights; Protection of Information, Assets and Interests; and Health, Safety, Environment, and Quality. We expect our Suppliers to adopt these standards throughout their supply chains by adopting efficient management policies, procedures, and training to uphold the standards set forth in the Supplier Code. Social Standards for Suppliers All Suppliers must treat their employees and those they conduct business with fairly and equally. As a Company, we require that all working hours are reasonable and fairly compensated in accordance with applicable laws and regulations. Suppliers shall ensure that all employees are paid living wages and operate in humane work conditions. Suppliers must also ensure that all labor is voluntary and that all employment contracts are freely entered into. We prohibit any usage of forced or child labor. Suppliers shall not engage in any action that utilizes forced or child labor in any aspect of their supply chain. Helios is committed to conducting our business ethically and with integrity. The Company’s commitment to diversity and inclusion is at the very core of our talent acquisition and overall employment practices. We define diversity and inclusion as: | | | | | | | • Diversity – a culture that values uniqueness

• Inclusion – an invitation for all individuals and groups to participate in every aspect of company life

• Belonging – the feeling each employee should have in bringing their authentic self to work and being accepted for who they are

• Echoing the words of our founder, Bob Koski, our commitment is to ensure that throughout our organization, we are fostering an environment that is harassment and discrimination free, that brings new and different perspectives and that attracts and retains a diverse workforce. We understand that it is our differences that bring us together to collectively achieve the same goals. We are determined to go beyond mere compliance with the law.

| | | |  | | |

Here are some of our recent accomplishments around diversity, inclusion and equity summarized in three main categories:

| | | | | | | | | ASPIRATIONAL GOALS

| | | | INCREASING REPRESENTATION

& ENGAGING CULTURE

| | | | LEARNING, DEVELOPMENT,

& AWARENESS

|

ASPIRATIONAL GOALS

Strategy and execution at the board and senior leadership level was just the beginning. We regularly seek our employees’ input, thoughts, feedback and collaboration as we continue to buildensuring a safe work environment where our colleagues feel comfortable being themselves,for all affiliates, subsidiaries, employees, vendors, and where they feel valued, respectedsuppliers. Suppliers must comply with all applicable laws and have a real opportunity to excel within our company.

Employees were surveyed and given a voice to weigh in on a variety of issues from core values, mission, their history with the organization, etc. We accomplished this via a variety of awareness sessions, development opportunities and monthly round tables where senior leaders interact, exchange information and listen to each one of our employees. We take great pride in maintaining an open and direct communication that develops a sense of belonging.

Each one of our operating companies maintains their own individual ethics and code of conduct policies as well as being fully committed to the Code, which sits above each operating company policy. Our organization lives these policies and takes steps to prevent discrimination and harassment in our workplaces, promotes ethical behavior, and supports diversity and inclusion within our workforce and business partners.

As noted above, Helios’s confidential ethics and reporting hotline that can be accessed by employees all over the globe under the oversight of our Chief Legal and Compliance Officer. Reported violations against our diversity and inclusion philosophy and practices are thoroughly investigated, and corrective actions are swift and effective.

| | |  | | 2021 Proxy Statement| 21 |

| Governance of the Company

|

INCREASING REPRESENTATION & ENGAGING CULTURE

Relationships with Third Parties

| | | | | | |  | |  | |  | | Increasing our commitment to the respect and dignity of all human life, we require all our third-party suppliers to execute a Code of Conduct for Suppliers and Third-Party Vendors which includes our Policy Against Human Trafficking and Slavery. |

Throughout the procurement process, we audit third party businessesregulations, including internal guidelines, to ensure they have receivedthat all employees are appropriately qualified and understand the policy. We issue questionnairesequipped to work safely.

Helios Policy Against Human Trafficking and require attestations that they agree to abide by it. We are committed to a zero-tolerance policy with respect to human trafficking and slavery. We train our internal procurement personnel to identify and report any behaviors inconsistent with our policy. We clearly communicate thatSlavery for usSuppliers For Helios to maintain a working relationship with any third parties, regardless of the country or type of cultural environment in which our vendors or associates operate, they must ensure that our commitment against any type of slavery or inhumane treatment is embedded in how they conduct business and how they hire, treat and maintain their own workers. No compromises. Internal EffortsHelios requires Suppliers to verify that their product supply chain standards do not utilize human trafficking or slavery. We train our internal procurement personnel to identify and report any behaviors inconsistent with our policy. Helios reserves the right in its contracts to audit Suppliers to ensure that standards related to human trafficking and slavery are upheld. Suppliers must be able to demonstrate compliance at the request and satisfaction of Helios.

| | |  | | Environmental |